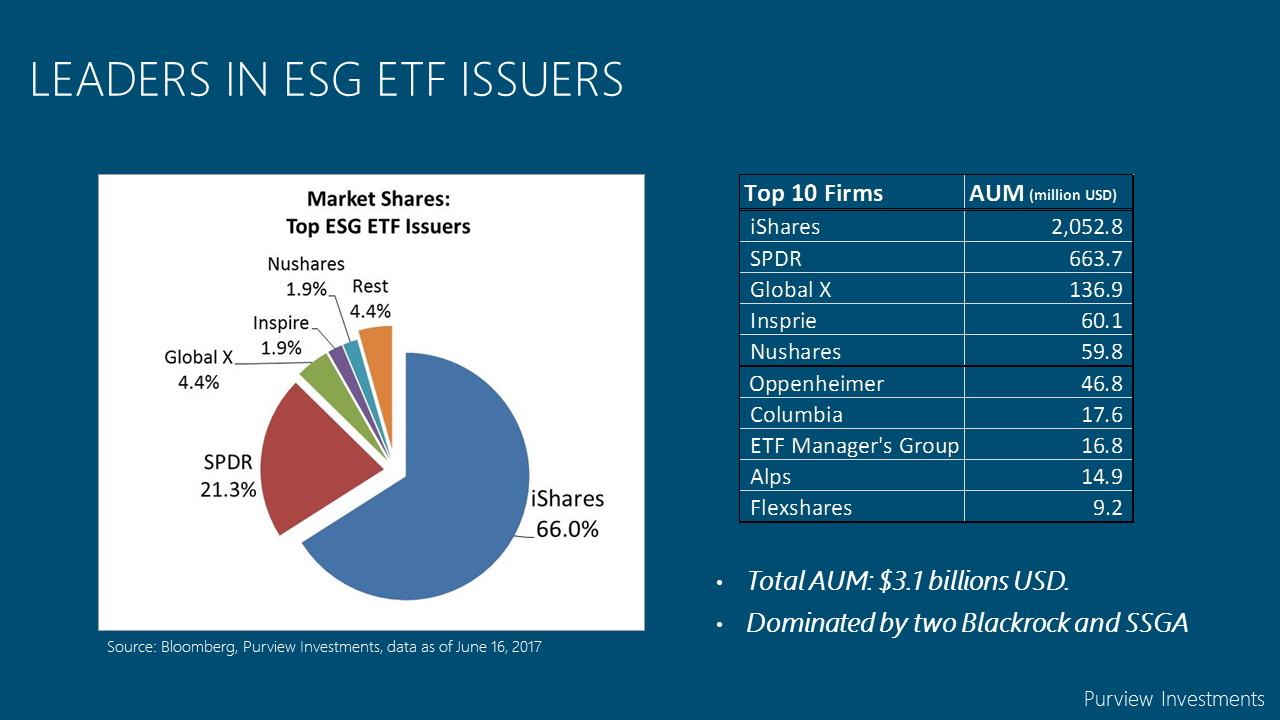

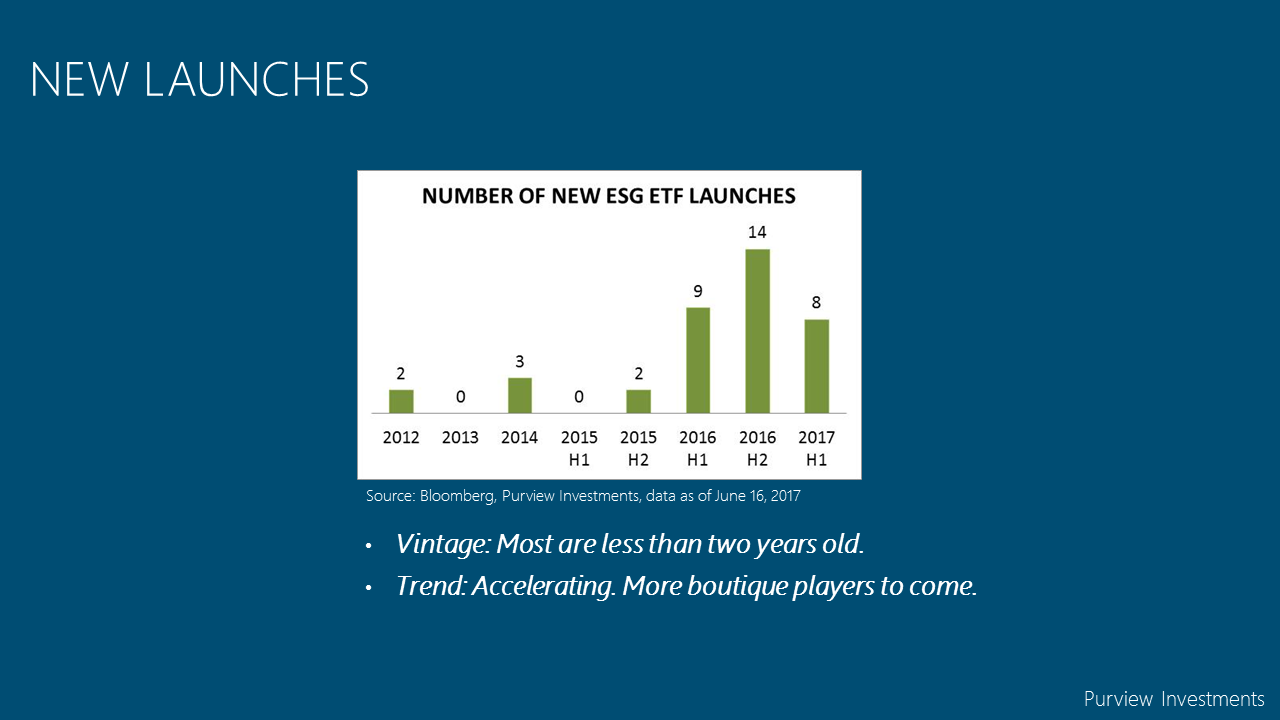

Dr. Zhang shared her recent research on the current state of the ESG ETF product space. This category is young,with 39 US listed ETFs, just over $3 billion in total AUM, dominated by Blackrock iShares and State Street SPDRs. The rest of the top five players may surprise you, with unique angles to ESG. Both Global X and Inspires made their ESG products known for their biblical responsible investing (BRI). Nuveen''s NuShares, on the other hand, are positioning itself with a full range of Russell investment style blocks for asset allocation purposes.

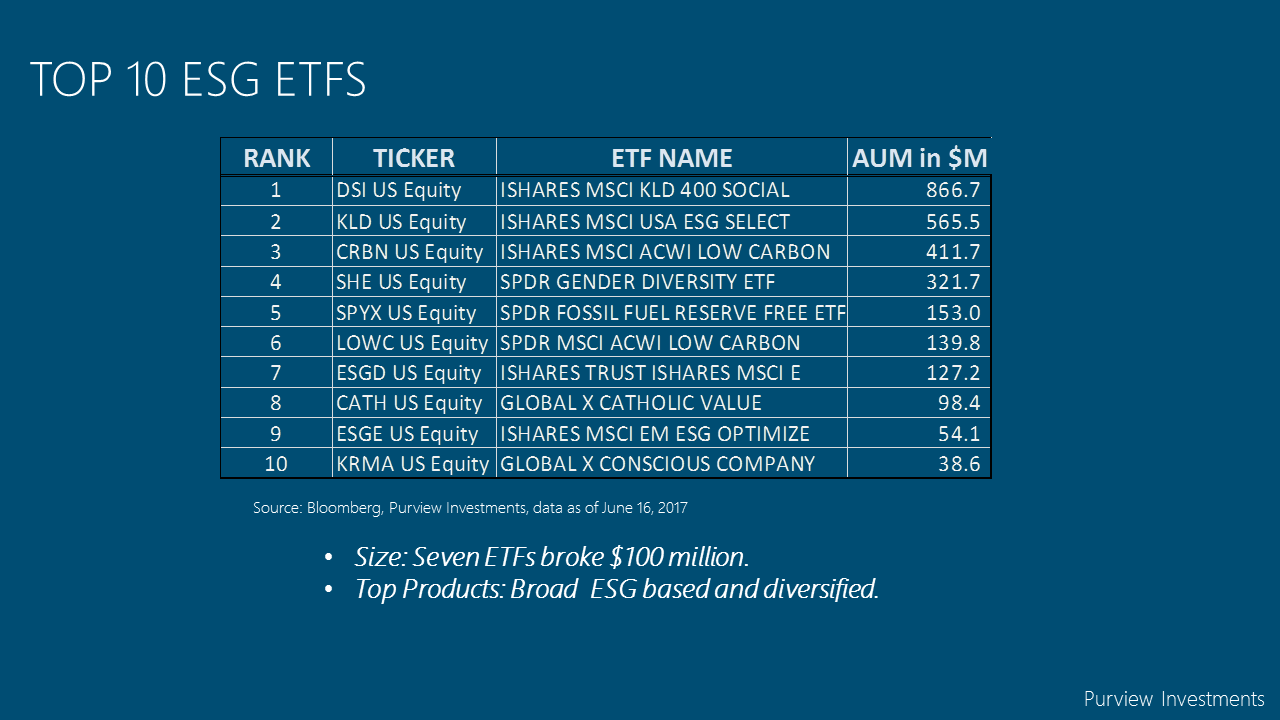

Although the top products focus on catch-it-all ETFs, capturing all aspects of Environment, Social and Governance, single mission ETFs also made to top ten, such as the SPDR's SHE gender equality ETFs, and Low Carbon ETFs by both iShares and SPDR.

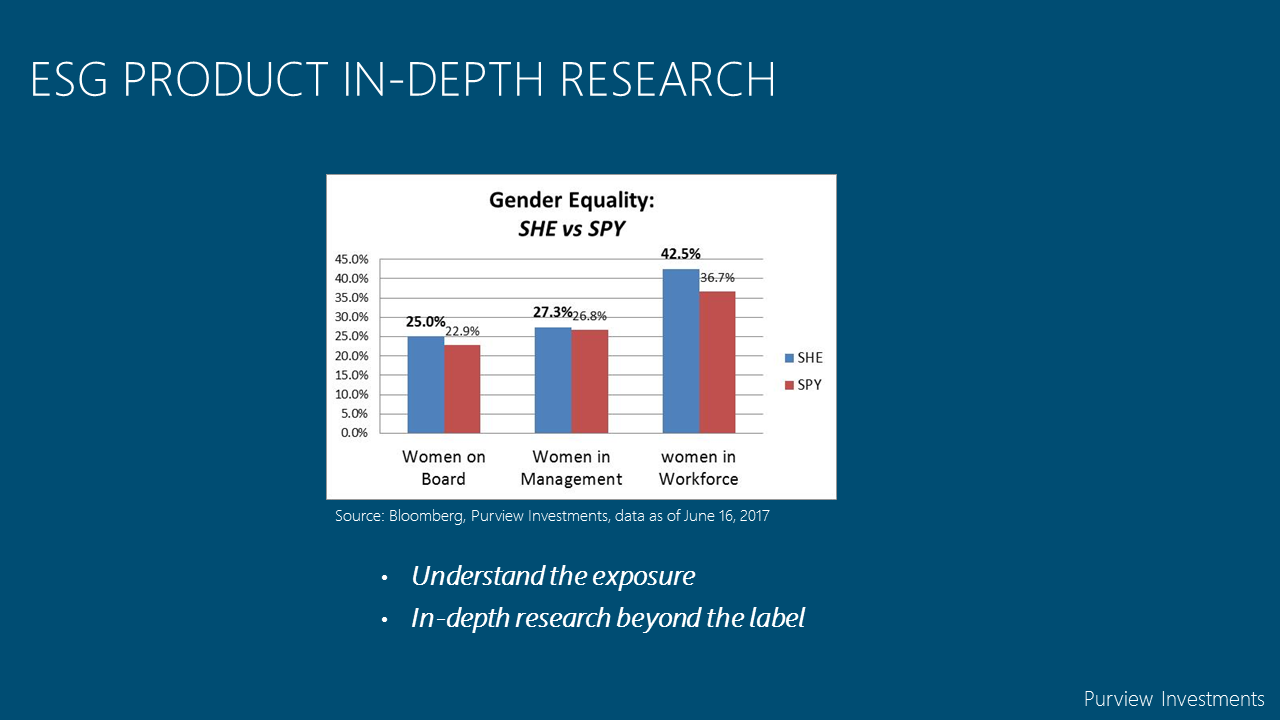

Zhang demonstrated the importance and framework of conduct ESG ETF research. Using SHE as a case study, she examined how well SHE is compared with the broad market index on various measures that SHE is supposed to deliver. Find out the answers and other important issues of understanding ESG ETFs from her slides created for the IMN conference.

Footnote: Due to technical difficulty, the slides were not shown during the conference. Zhang is happy to share with the online audience here.